US formalizes auto imports quota for UK

A US-UK trade deal formalized today establishes a quota for UK-made cars to be imported into the US and lifts tariffs on aircraft parts but glosses over an earlier promise to carve out quotas for UK-sourced steel and aluminum.

US president Donald Trump and UK prime minister Keir Starmer unveiled the finalized agreement today, on the sidelines of the G7 summit in Alberta, Canada.

Both leaders offered praise for the deal — Trump called the countries’ relationship “fantastic” and Starmer said it was a “really important day”.

While details are few, the agreement limits the number of UK-built cars that can be imported into the US at 100,000 and imposes a 10pc tariff on those vehicles. The US since 3 April has been charging a 25pc tariff on all imported cars. The deal also calls for lifting US tariffs on UK-made aircraft equipment.

The Trump administration pledged in early May to carve out a quota system for UK-sourced steel and aluminum. Trump on 4 June raised tariffs on foreign sourced steel and aluminum to 50pc but kept the tariff rate for the UK at 25pc.

The agreement signed today merely promises that the US administration would do so “at a future time”.

If a quota system is established for the UK, it would allow importing steel and aluminum without the 25pc tariff, the White House said.

The trade agreement keeps in place a broad 10pc tax on all imports from the UK, which Trump imposed on 2 April as part of his “Liberation Day” tariff announcement that cited an “economic emergency” created by US trade deficits.

A US federal appeals court on 31 July will hear arguments from the administration and from a group of plaintiffs, including many US states, who are challenging Trump’s authority to impose tariffs by citing economic emergencies.

Trump imposed tariffs on imports of steel, aluminum, cars and auto parts by using a different authority, which has so far not been challenged in courts.

The trade deal with the UK is one out of two, in addition to a preliminary deal with China, that the administration has negotiated since Trump began to impose tariffs on nearly every US trading partner — after promising in early April to conclude “90 deals in 90 days”.

Trump said today, “We have our trade agreement with the EU, and we have other many, many other ones coming that you will see.”

The Trump administration has not presented any other trade agreement yet

April 2025 crude steel production

World crude steel production for the 69 countries reporting to the World Steel Association (worldsteel) was 155.7 million tonnes (Mt) in April 2025, a 0.3% decrease compared to April 2024.

Crude steel production by region

Africa produced 1.9 Mt in April 2025, up 6.3% on April 2024. Asia and Oceania produced 115.0 Mt, up 0.1%. The EU (27) produced 11.1 Mt, down 2.6%. Europe, Other produced 3.4 Mt, down 0.5%. The Middle East produced 5.2 Mt, up 2.2%. North America produced 9.0 Mt, up 0.2%. Russia & other CIS + Ukraine produced 6.9 Mt, down 4.4%. South America produced 3.3 Mt, down 2.4%.

Table 1. Crude steel production by region

| Apr 2025 (Mt) | % change Apr 25/24 | Jan-Apr 2025 (Mt) | % change Jan-Apr 25/24 | |

| Africa | 1.9 | 6.3 | 7.7 | 4.0 |

| Asia and Oceania | 115.0 | 0.1 | 463.9 | 0.3 |

| EU (27) | 11.1 | -2.6 | 43.5 | -2.4 |

| Europe, Other | 3.4 | -0.5 | 13.9 | -6.2 |

| Middle East | 5.2 | 2.2 | 18.4 | -5.7 |

| North America | 9.0 | 0.2 | 35.9 | 0.3 |

| Russia & other CIS + Ukraine | 6.9 | -4.4 | 27.3 | -3.4 |

| South America | 3.3 | -2.4 | 13.7 | -1.5 |

| Total 69 countries | 155.7 | -0.3 | 624.4 | -0.4 |

The 69 countries included in this table accounted for approximately 98% of total world crude steel production in 2024.

Regions and countries covered by the table:

- Africa: Algeria, Egypt, Libya, Morocco, South Africa, Tunisia

- Asia and Oceania: Australia, China, India, Japan, Mongolia, New Zealand, Pakistan, South Korea, Taiwan (China), Thailand, Viet Nam

- European Union (27): Austria, Belgium, Bulgaria, Croatia, Czechia, Finland, France, Germany, Greece, Italy, Luxembourg, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden

- Europe, Other: Macedonia, Norway, Serbia, Türkiye, United Kingdom

- Middle East: Bahrain, Iran, Iraq, Jordan, Kuwait, Oman, Qatar, Saudi Arabia, United Arab Emirates, Yemen

- North America: Canada, Cuba, El Salvador, Guatemala, Mexico, United States

- Russia & other CIS + Ukraine: Kazakhstan, Russia, Ukraine

- South America: Argentina, Brazil, Chile, Colombia, Ecuador, Paraguay, Peru, Uruguay, Venezuela

Top 10 steel-producing countries

China produced 86.0 Mt in April 2025, the same as in April 2024. India produced 12.9 Mt, up 5.6%. Japan produced 6.6 Mt, down 6.4%. The United States produced 6.6 Mt, down 0.3%. Russia is estimated to have produced 5.8 Mt, down 5.1%. South Korea produced 5.0 Mt, down 2.5%. Türkiye produced 3.0 Mt, up 7.0%. Germany produced 3.0 Mt, down 10.1%. Brazil produced 2.6 Mt, down 3.1%. Iran produced 3.3 Mt, up 4.6%.

Table 2. Top 10 steel-producing countries

| Apr 2025 (Mt) | % change Apr 25/24 | Jan-Apr 2025 (Mt) | % change Jan-Apr 25/24 | ||

| China | 86.0 | 0.0 | 345.4 | 0.4 | |

| India | 12.9 | 5.6 | 53.2 | 6.9 | |

| Japan | 6.6 | -6.4 | 27.0 | -5.3 | |

| United States | 6.6 | -0.3 | 26.4 | 0.0 | |

| Russia | 5.8 | e | -5.1 | 23.4 | -4.5 |

| South Korea | 5.0 | -2.5 | 20.5 | -3.4 | |

| Türkiye | 3.0 | 7.0 | 12.3 | -1.0 | |

| Germany | 3.0 | -10.1 | 11.4 | -11.9 | |

| Brazil | 2.6 | -3.1 | 11.0 | -0.3 | |

| Iran | 3.3 | 4.6 | 10.6 | -8.0 |

e – estimated. Ranking of top 10 producing countries is based on year-to-date aggregate

Increased US tariffs on steel, aluminum to affect domestic market

The rating agency Fitch Ratings warned that the increased tariffs from 25% to 50% on all steel and aluminum products imposed by the US could affect primarily its own domestic market.

Fitch emphasized that if the increased tariffs remain in place for a longer period, US´s industrial sectors will see their margins reduced due to higher material prices.

In 2023, the country imported about 18% of the steel it consumed. The situation is worse for aluminum while the country produced only 0.7 million tons compared to a total consumption of 4.7 million tons; 70% of the total came from Canada.

Fitch noted that when similar tariffs were introduced in 2018, steel prices rose 43%, although the trend reversed in early 2019. For this time, hot-rolled steel prices have increased 13%.

Turkey’s CRC imports up 31.6 percent in January-April

In April this year, Turkey’s cold rolled coil (CRC) imports amounted to 72,027 metric tons, increasing by 37.7 percent compared to March and 17.8 percent year on year, according to the preliminary data provided by the Turkish Statistical Institute (TUIK). Meanwhile, the value of these imports totaled $48.11 million, up by 37.7 percent compared to the previous month and 3.7 percent year on year.

In the January-April period, Turkey‘s CRC imports amounted to 286,228 mt, up 31.6 percent, while the value of these imports increased by 11.7 percent to $189.25 million, both year on year.

Turkey’s cold rolled coil imports – last 12 months

In the given period, Turkey’s largest CRC import source was South Korea, which supplied 94,868 mt, up 40.8 percent year on year. South Korea was followed by Russia with 69,643 mt, up 39.4 percent year on year and China with 59,783 mt, up 116.0 percent compared to the same period last year.

Turkey’s top 10 CRC import sources in the January-April period this year:

| Country | Amount (mt) | |||||

| January-April 2025 | January-April 2024 | Y-o-y change (%) | April 2025 | April 2024 | Y-o-y change (%) | |

| South Korea | 94,868 | 67,381 | 40.8 | 20,264 | 25,445 | -20.4 |

| Russia | 69,643 | 49,976 | 39.4 | 21,919 | 15,335 | 42.9 |

| China | 59,783 | 27,676 | 116.0 | 18,919 | 2,452 | 671.6< |

Zimbabwe and Zambia Sign Historic MoU to Build Cross-Border Fuel Pipeline

The Zimbabwe government has approved a Memorandum of Understanding (MOU) with the neighbouring Zambia to build a pipeline to transport refined petroleum products from Zimbabwe to Zambia.

Minister of Information, Publicity and Broadcasting Services, Jenfan Muswere, disclosed the developments during a post-cabinet press briefing held in Harare on Tuesday, June 10, 2025, adding that the pipeline would ease the country’s reliance on road transport, eliminating the risks associated with such a mode of fuel transport.

“Cabinet approved the MoU between the Republic of Zimbabwe and the Republic of Zambia in Facilitating Private Sector Development and Implementation of the Zimbabwe-Zambia Oil Products and Natural Gas Pipelines Project,” the Ministry of Information, Publicity & Broadcasting stated on X (formerly Twitter).

“The MoU will facilitate the development of a new pipeline system to transport refined petroleum from Zimbabwe to Zambia. The MoU leverages on Zimbabwe’s existing capacity for oil and gas storage, processing and transportation coupled with Zambia’s growing demand for affordable and efficient energy use.”

“Transporting fuel to Zambia by pipeline is expected to take fuel tankers off the roads, thereby reducing damage to road infrastructure.”

The newly signed MoU will leverage Zimbabwe’s existing oil storage, processing, and transport infrastructure to meet the skyrocketing demands in Zambia, deepening bilateral ties between the two landlocked neighbours.

While the project’s implementation details had not yet been shared with the public at the time of reporting, the pipeline project is expected to streamline fuel transport between Zimbabwe and Zambia, lower consumer prices, and reduce safety risks often associated with road transport.

Flat-rolled steel demand could be in for a slow summer

Steel prices, which normally fall a bit during the summer, appear to be heading downward even before the summer season officially begins. This mostly seems to be linked to a forecast downturn in demand. claffra/iStock/Getty Images Plus

OEMs typically take downtime in June and July. It’s one of the reasons why you rarely see prices shoot higher in the early summer. (I sometimes wonder why mills do outages in the spring when their customers do them in the summer, but I digress.)

Sure, mills might announce price hikes over the summer, but often it’s to try to slow any price declines.

In recent years, prices have regularly peaked in April, slipped in the summer, and then recovered in the fall. (Let’s forget last year, which was a little unusual. There was no recovery in the fall—just one very long bottom and no recovery until winter—but you get the picture.)

Generally speaking, we’ve seen sheet prices rise in the summer only if there has been an external shock, such as the surprise imposition of Section 232 tariffs on Canada and Mexico in 2018 or the unexpected rebound in demand throughout 2021 following a pandemic-stricken 2020. We saw prices rise through the summer in both years.

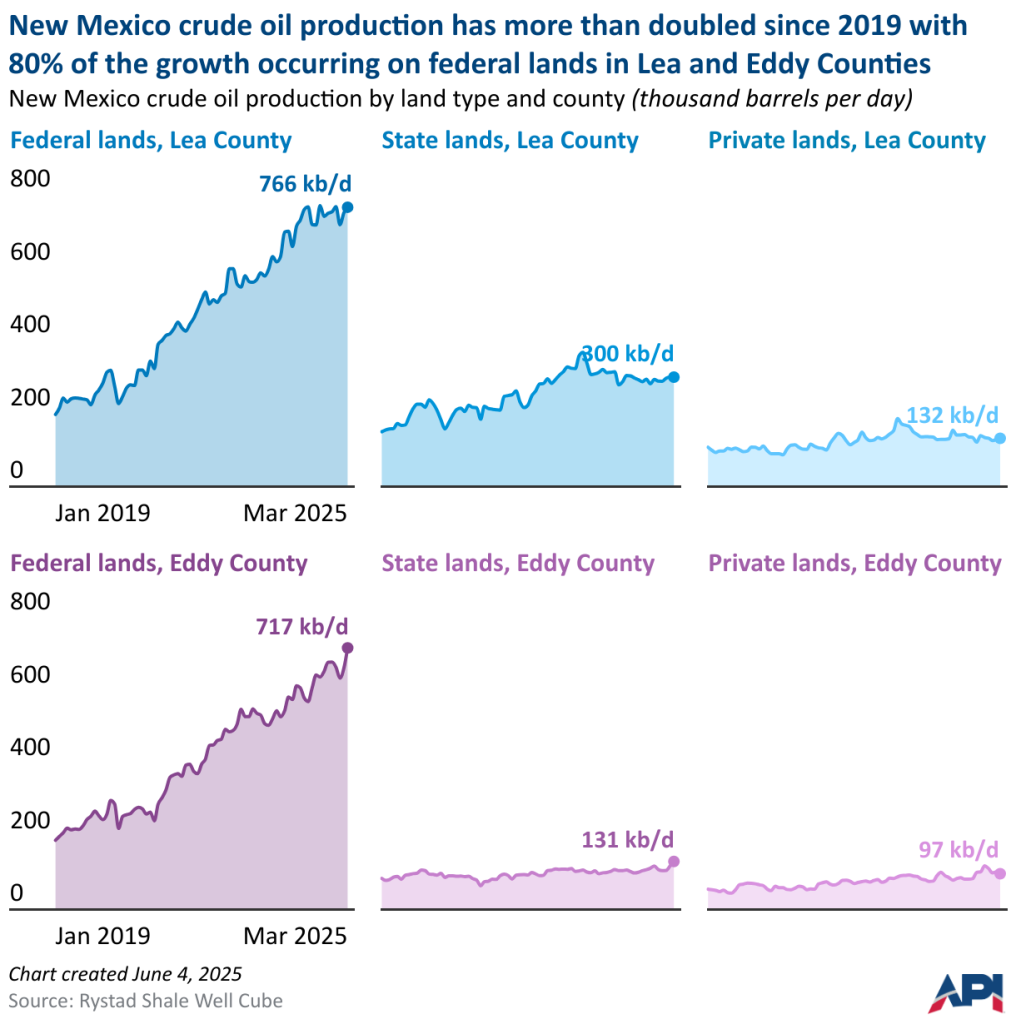

New Mexico’s crude oil production has continued to set new records with growth concentrated on federal lands in Lea and Eddy Counties

New Mexico’s crude oil production rose to a record high for a second consecutive month in March 2025, growing by 100 kb/d from February to 2.26 mb/d. New Mexico’s crude oil production has more than doubled since 2019 with 80% of the growth occurring on federal lands in Lea and Eddy Counties. Nearly 70% of New Mexico’s crude oil production occurs on federal land vs. 27% of total U.S. crude production.